Customer service brokers can provide a superior expertise throughout any channel, whether or not e-mail, social media, or chat. CRM permits a clear crm for stock brokers view of how clients work together together with your group compared to different customer relationship management systems. For occasion, a lead filled out a kind on a landing page after viewing an commercial on social media. It helps connecting with your prospects across all main touchpoints. The benefits of CRM for enterprise assist in numerous departments like sales, advertising, customer service, and extra.

- Thus, the CRM helps provide all the information and past interactions with the company/product to the gross sales team to allow them to construct that relationship with that info.

- Even the finance staff benefits, as they’ll see which services or products are making the most cash.

- These clients expect fast service, customized interactions, and an integrated experience.

- With the assistance of this, you could also make any necessary actions that will really help you to enhance the enterprise and growth in an efficient method.

Elevated Sales/ Boosts Revenue

Alternatively, if you’re on the lookout for a extra practical walk-through of how CRM can benefit your business and positively impression your customer relationships, schedule a demo with considered one of our consultants right here. Apart from being a fantastic asset in finding and nurturing your potential and new customers, CRM can additionally be a great software for preserving your present prospects happy. Eventually it becomes increasingly troublesome to centralize and streamline your communications with prospects, both potential and present. In addition – 85% of CRM customers discovered improved customer experience to be a huge benefit to utilizing a CRM system, while 58% of CRM customers have been capable of make much faster choices. To perceive the advantages of CRM in hospitality, let’s discover the challenges confronted by professionals and prospects throughout the business. The hospitality trade is huge, encompassing everything from meals, lodging to travel and tourism sectors.

Build Your Dream Project With Us

So when a salesman speaks with a buyer and learns more about them, they can add notes to their document, which may then be seen throughout your organisation. Successful companies are at all times in search of ways to improve their buyer assist department. The development of chatbots is promising, however they are yet to exchange actual people.

Understanding How Recruitment Crm Can Benefit Your Business – 2023

Such information is helpful in concentrating on sure prospects that are likely to profit the enterprise. This is a useful feature for businesses which have a number of shopper touchpoints in their gross sales pipeline or who handle complicated tasks. Systemizing as many business processes as potential without dropping the worth is necessary to any high-functioning staff. General Data Protection Regulation (GDPR) has remained one of many prime buzzwords for the previous a number of years and hereby, many suppose it’s a directory that one wants to hold up and comply with up. But, this is not confined to it, it’s something huge than one may even think of!

Largest Advantages Of Crm Software For A Startup

It reveals actionable insights about your small business health and alternatives you’ll have the ability to work on to improve your corporation growth. Using buyer knowledge, organizations can shape strategies to ship exceptional customer experiences and drive enterprise outcomes. To address these challenges, implementing a CRM system, particularly designed for the hospitality business is crucial for managing in depth knowledge.

Top 5 Methods To Improve Sales With Crm Software/ Benefits Of

CRM, in a nutshell, is the administration tool that retains your prospects delighted, your staff on monitor, and your corporation rising. It’s like having a superhero by your facet, making sure every little thing happens well. These benefits add as much as higher sales conversion charges, higher client retention, and, finally, elevated income and success for each individual sales representatives and their companies. Everyone with entry to your CRM can work together by way of this shared report.

Higher Collaboration Within Your Group

While time-consuming administrative duties hold your sales staff from doing what they want to be doing—selling. A good CRM system keeps data in one centrally situated, easily accessible place, making correct, real-time reporting and forecasting straightforward. CRM options might help keep observe of contacts within a enterprise, to permit both gross sales and advertising teams to personalize communication. Good CRM solutions can supplement their account and get in contact with knowledge by way of third-party data sources so that every one info is complete and updated.

Looking For A Name Tracking Crm For Your Business?

Employees are the necessary property of a company, representing services before clients. This is why their productiveness is crucial for sustaining the requirements of customer support. A CRM platform allows resort managers to monitor the efficiency of every worker from a single dashboard.

Responding to your customer’s requests quickly is a sign of professionalism. And when you can be succesful of perform this follow-up in a much better way, you can actually improve your conversion in addition to income in a a lot simple way. Because whenever you carry out gross sales automation, it saves plenty of handbook recurring work and turns your gross sales staff can carry out higher.

Some inquire about admissions, others about visa processes, and a few are thinking about work permits. Managing these numerous needs can be chaotic with out the best tools. This is the place Multiple Lead List Management in an schooling consultancy CRM comes in handy. A Study Abroad CRM is important for schooling consultancies to streamline and enhance overseas admissions. Meritto’s Study Abroad CRM is purpose-built to handle leads, automate processes, and guarantee seamless operations for research abroad brokers. Unlike generic CRMs, it offers specialized options tailor-made for education consultants to handle the complexities of worldwide scholar recruitment effectively.

Therefore, the teams would have the power to compensate for gross sales, marketing to the right people, and rather more. And many tools are there to carry out the follow-up, like, as you can put a reminder in Google calendar and all those issues, but a CRM is having many advanced options. You can have the power to handle your whole history of the dialog, no matter you had with the lead, and you’ll not miss out on any of the information.

A feature-rich CRM is simply nearly as good as the support that comes with it. Meritto understands this and offers robust customer support to guarantee that users benefit from their Study Abroad CRM. A dedicated customer assist staff is available to guide counselors and directors through any challenges they may face.

A CRM system is software that assists companies in tracking & managing buyer relationships. Delivering an distinctive buyer expertise is crucial for business development. Customer satisfaction not solely improves relationships but also generates crucial referrals.

A collaborative CRM supplies each staff with real-time entry to up-to-date customer data in one location. This contains marketing information (such as what material a lead has interacted with), any transactions made by a buyer, and any earlier buyer engagement with any staff member. With this sort of CRM, anybody can simply entry a document of all earlier contacts and gain a greater understanding of their consumer’s necessities and pursuits. Cloud primarily based CRM system is integrated with other applications like e mail, social media functions like Facebook, Twitter, Linked In, and Instagram. It additionally permits you to market your products via e-mail campaigns and the social media spheres. Even cellular CRM, permits you to market your products by way of multiple channels from wherever you are.

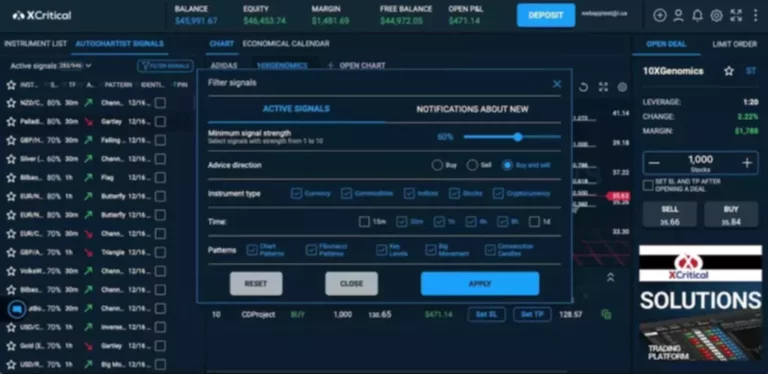

Read more about https://www.xcritical.in/ here.